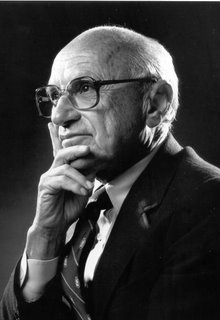

R.I.P. Uncle Milty

Milton Friedman, warmly referred to as "Uncle Milty" in not a few of my economics classes at school, died today at age 94. He has been associated with both institutions of higher education represented by G&S authorship. His approach of "think about things carefully and don't be a crazy person" is used lamentably infrequently nowadays.

Milton Friedman, warmly referred to as "Uncle Milty" in not a few of my economics classes at school, died today at age 94. He has been associated with both institutions of higher education represented by G&S authorship. His approach of "think about things carefully and don't be a crazy person" is used lamentably infrequently nowadays.[UPDATE by Gentleman Farmer] It is impossible to exaggerate the importance of Professor Friedman and his ideas. It is also difficult for those younger than a certain age to grasp just how controversial and out of the mainstream his ideas were at one time. Even 35 years ago, when I studied economics at Rutgers, it was made clear to us that many of the things we were taught were considered heretical at other schools. Part of the problem was that so many of his theories included a high proportion of common sense, and could be understood apart from the mathematics that demonstrated their truth to other economists.

How, for example, do individuals react to changes in their income? If someone gets a raise, how much of it does he spend, and how much does he save? If someone loses their job, do they quickly move back in with their parents, and sell their car and ride the bus? It seems obvious from personal experience that they don't. And while data clearly shows that higher income individuals save a higher proportion of their income (of course!) data also shows that increases and decreases in a person's income over time do not result in proportionate changes. This is because people make their spending (and therefore saving) decisions based not on how much they made this week, but based on how much they expect to make over longer periods of time, perhaps even over their lifetimes. This is not that complicated a concept, and fits with the personal experience of most people. Friedman won the Nobel Prize for explaining it.

Friedman also believed that he had put over a colossal boondoggle on the taxpayers of the State of New Jersey -- a fraud also perpetrated by your author:

One of the dumber things ever done by the Hired Hand was never going over to Friedman's office at the Hoover Institution and shaking his hand, despite spending four years in close proximity thereto.

Comments on "R.I.P. Uncle Milty"

post a comment